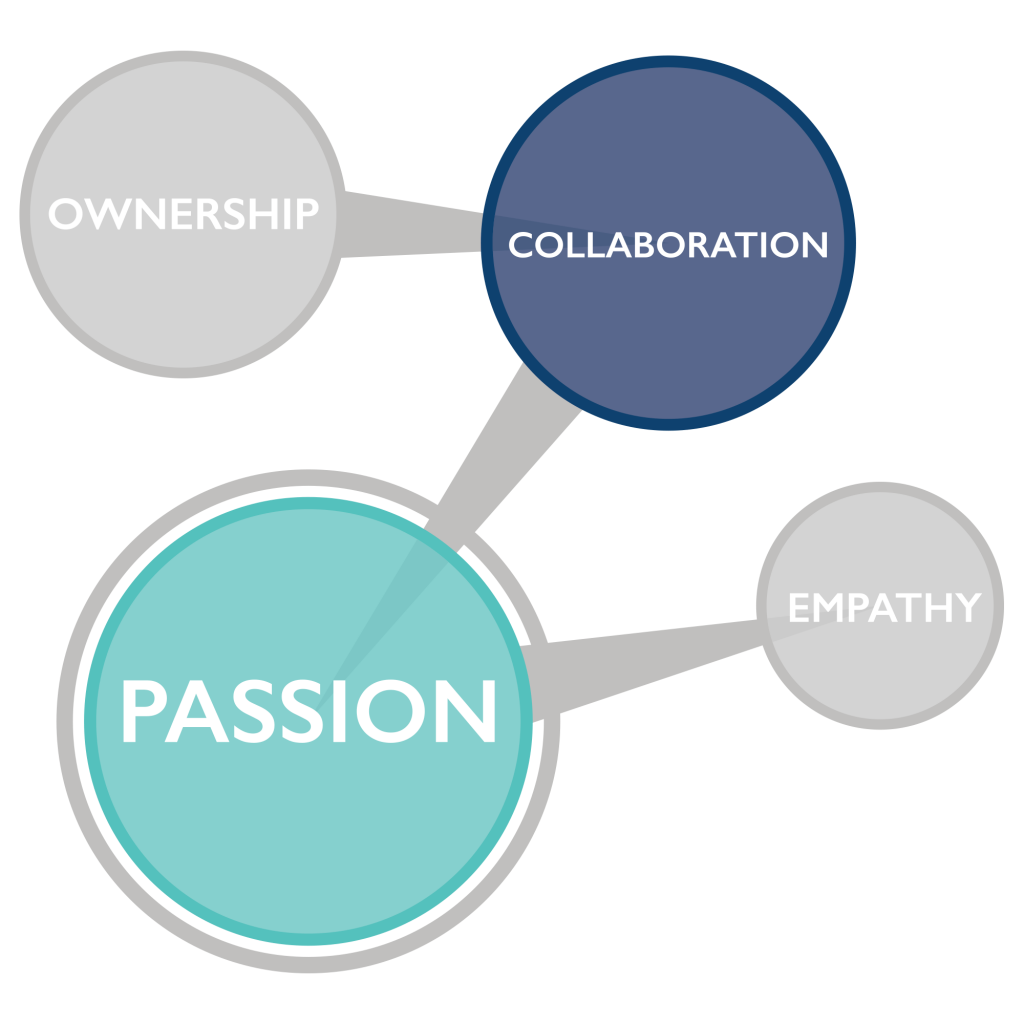

PASSION: Everything we do revolves around a passionate approach to getting the job done, whatever that job may be. We are guided by trust, respect and honesty, and we’re driven by “what’s next”.

COLLABORATION: The whole is greater than the sum of its parts. Together, everyone achieves more, and synergies across the IFH family of companies are what take us to the next level, bringing unparalleled value to our clients.

OWNERSHIP: Productivity ceases through micromanagement. We are entrepreneurs, highly skilled operators, niche subject matter experts and trust our colleagues to take extreme ownership in everything they do.

EMPATHY: Client success is our success. Our single-focused purpose is to understand what’s important to our clients, what’s getting in their way, and what they hope to achieve, so we can help them get there.

Copyright © 2023 Integrated Financial Holdings, Inc. All Rights Reserved.

8450 Falls Of Neuse Road, Suite 202

Raleigh, NC 27615 | (919) 861-8018 |

RiskScout is a "RegTech" (Regulatory Technology) platform designed to accelerate WTBT’s review of hemp-related businesses by automating the onboarding, validation and monitoring processes needed for enhanced due diligence for high risk customers.

Visit Website >>

West Town Insurance Agency is based in Edenton, North Carolina. As an independent agency, the Company represents various carriers and has the ability to compare coverage and pricing to find the best possible value for personal or business insurance needs.

Visit Website >>

Glenwood is a transaction advisory and placement agent created to fill the gaps in the financing processes for community and regional lenders, providing a full suite of services for sub-middle market capital transactions.

Visit Website >>

SBA Loan Docs provides a holistic and sequenced approach to the preparation of loan documentation under the SBA’s 7(a) Loan Program. Staff is comprised of seasoned loan closers and veteran attorneys with decades of SBA lending experience.

Visit Website >>

Windsor provides community banks and credit unions with a comprehensive outsourced SBA 7(a) and USDA lending platform, servicing nearly $2.0 billion in assets for hundreds of lenders across the country.

Visit Website >>

WTBT offers payment processing solutions for small and medium sized businesses of all types, including compliance-driven segments through its joint venture with West Town Payments.

Visit Website >>

WTBT promotes savings and home ownership through a variety of mortgage programs, including VA, FHA, USDA, Jumbo and Conventional loan programs.

Visit Website >>

WTBT offers a wide range of traditional banking services but selectively specializes in government guaranteed lending nationally, as well as tailored deposit products for specific lines of business and cash management solutions for industries such as Hemp and CBD.

Visit Website >>

WTBT is focused on lending programs supported by the U.S. Federal Government, including the SBA (7(a), 504) and USDA (B&I, REAP, FSA, CF) programs. Since 2011, WTBT has authorized more than $1 billion in loans to businesses located in 41 states.

Visit Landing Page >>

WTBT offers technology enabled loan processing solutions to serve small businesses with financing needs of less than $350,000.

Visit Landing Page >>

WTBT has a team dedicated to help design cash management solutions based on the unique needs of its small business clients.

Visit Landing Page >>

Chairman

Mike serves as an Executive Vice President at IFH, Inc. and West Town Bank & Trust, helping drive the overall strategic direction of both companies. He previously served as the President & CEO of Windsor Advantage, LLC. Prior to joining the IFH family, Mike was a Senior Management Consultant with KPMG where he gained extensive experience working with diversified financial firms to implement efficiencies and risk management strategies. He began his career with PNC Capital Markets and graduated with honors from Miami University of Ohio with a degree in Finance and Accounting.

Eric is both President & CEO of West Town Bank & Trust and its parent company, Integrated Financial Holdings, Inc. (“IFH” formerly known as West Town Bancorp, Inc). In his roles, Eric establishes the overall vision and strategic direction of IFH and all of its wholly-owned subsidiaries. Eric is a Member of the North Carolina State Banking Commission that supervises, directs and reviews the activities of the Office of the Commissioner of Banks and serves as a Member of the Board of Directors at Dogwood State Bank. Eric’s prior experiences include Advisory Board Member of the Federal Home Loan Bank of Chicago, CEO of Morehead City-based Sound Bank, President & CEO of New Vision Mortgage, President of Anova Financial Corporation and Senior Vice President & Chief Operating Officer of OBA Bank. Throughout his 30-year career in the banking industry, Eric has been active in establishing, acquiring, selling and recapitalizing banks and other financial services companies, as well as being the lead organizer of a de novo bank. Eric earned a Bachelor’s and Master’s in business from The University of Alabama.

Riddick joined West Town Bank & Trust in 2011 and leads the Bank’s Government Guaranteed Lending division. Providing strategic and business development oversight, Riddick is responsible for all SBA and USDA front-end loan production, including pricing, creative structuring, product diversity and strategic partnerships. Riddick and his team have helped provide over $1 billion in loans to more than 500 entities. Riddick’s primary niche has been within the solar electric power generation space through USDA’s Rural Energy of America Program (REAP). Riddick graduated from North Carolina State University and has over 20 years of experience in the banking industry.